Introduction to Minimum Wage Law

Minimum wage law is the foundation of wage protection for workers across the United States. At its core, the minimum wage sets the lowest legal amount that employers can pay their employees per hour of work. The federal minimum wage, established by the Fair Labor Standards Act, is currently $7.25 per hour—a rate that has remained unchanged for over a decade. This federal rate acts as a baseline, but many states and cities have chosen to increase their minimum wage above the federal minimum to better reflect local costs of living and economic conditions.

In 2026, millions of workers and thousands of employers will be affected as states and cities across the country increase their minimum wage rates. These changes are designed to ensure that employees receive fair pay for their labor and to help protect against wage exploitation. The minimum wage law requires that all covered workers are paid at least the applicable minimum, whether that’s the federal minimum wage or a higher state or local rate. Employers must stay informed and compliant, as failing to pay the correct minimum can result in penalties and back pay requirements.

Because minimum wage rates can vary widely depending on location and industry, it’s essential for both workers and employers to know which laws apply to them. In some areas, cities have set their own minimums that exceed both the state and federal rates, while in others, the federal minimum wage of $7.25 per hour remains the standard. As more states and cities move to increase their minimum wage in 2026, understanding the basics of minimum wage law is more important than ever for anyone earning or paying hourly wages in the U.S.

Key Takeaways

- Most minimum wage increases in 2026 take effect on January 1, 2026, with additional changes on July 1 and September 30, 2026.

- The federal minimum wage stays at $7.25 per hour in 2026—unchanged since 2009 and with no congressional action scheduled.

- At least 19–22 states plus dozens of cities and counties will raise their wage floors on or around New Year’s Day 2026, as reported by Fox Business, HuffPost, Axios, and WFAA.

- By the end of 2026, 79 or more jurisdictions will have minimum wages at or above $15 per hour, including California, New York, Florida, and Washington State.

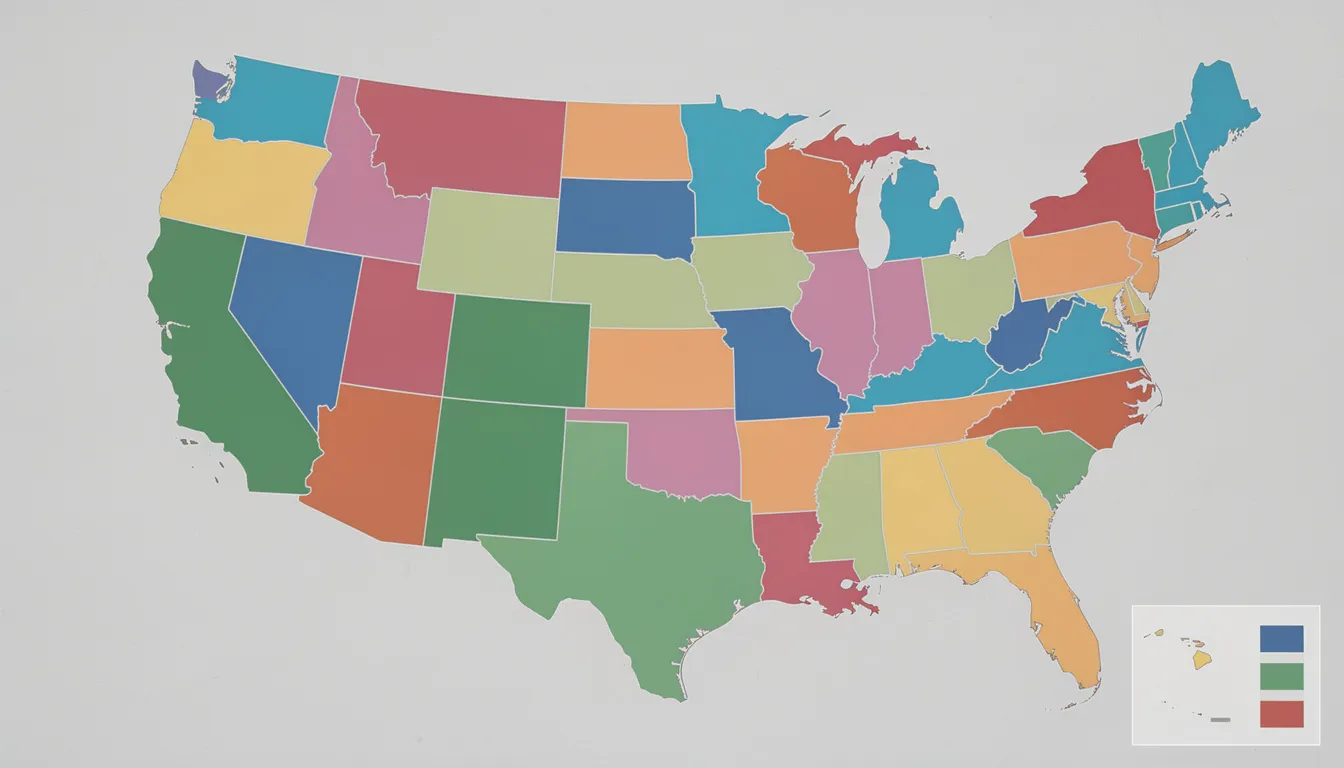

- Workers in 20 states will remain stuck at the federal rate of $7.25 per hour with no scheduled raise in 2026.

When Is the Minimum Wage Going Up Next?

The next major wave of minimum wage increases happens on January 1, 2026. That’s when at least 19–22 states and dozens of cities and counties will raise their wage floors, giving millions of workers higher wages heading into the new year.

According to coverage from Fox Business and HuffPost, approximately 8.3 million workers will be directly affected by these New Year’s Day pay increases. Many more workers earning just above the new minimums will be indirectly affected as employers adjust their pay structures.

Additional increases arrive mid-year on July 1, 2026, in places that index wages to inflation. Washington, D.C. and several West Coast cities fall into this category. Then on September 30, 2026, Florida’s statewide minimum wage reaches $15.00 per hour—a milestone years in the making.

Here’s the uncomfortable reality: 20 states will still sit at the federal $7.25 per hour in 2026. These states have no scheduled increase, which deepens geographic differences in pay levels across the country. If you work in one of these states and want to know when the minimum wage will go up for you, the answer depends entirely on whether your city or county has its own local minimum wage law.

Scroll down for state-by-state highlights, major city changes, and a complete 2026 timeline.

What Is the Federal Minimum Wage in 2026?

The federal minimum wage remains $7.25 per hour in 2026. This rate has been frozen since July 24, 2009—over 15 years without a single adjustment.

The rate is set by the Fair Labor Standards Act (FLSA) and applies in states that either have no state minimum wage or have one set below $7.25. It covers most private-sector employees who work for employers engaged in interstate commerce.

Congress must pass new legislation for the federal minimum wage to rise. Unlike many state and local wage floors, there is no automatic inflation adjustment at the federal level. Proposals like the Raise the Wage Act have been introduced repeatedly but have not passed.

Because the federal rate has been frozen for so long, most of the minimum wage action in 2026 comes from state and local governments—not from federal lawmakers. This is why tracking when the minimum wage will go up requires looking at your specific state and city, not just Washington, D.C.

One important distinction: federal contractors follow a separate minimum wage schedule that is higher than $7.25 per hour. This contractor minimum is distinct from the general federal minimum and applies specifically to workers on federal contracts.

Minimum Wage Increases on January 1, 2026

New Year’s Day 2026 is the single biggest date for scheduled minimum wage hikes. Nearly 20+ states and dozens of localities will raise their rates that day, making it the most significant annual date for pay increases across the country.

According to reporting from Fox Business, HuffPost, and Axios, the January 1, 2026 minimum wage increases will affect workers across multiple regions.

Northeast Region

New York State leads with significant increases. New York City, Long Island, and Westchester County will see their minimum wage rise to $17.00 per hour, while the remainder of York State will have a slightly lower rate. Rhode Island is rising to $16.00 per hour statewide on January 1, 2026.

West Coast

California’s statewide minimum is increasing again, with projections pointing toward rates approaching $16.50 or higher. Many California cities go significantly higher—San Diego, South San Francisco, and West Hollywood all maintain local minimums that exceed the state floor. Washington State continues its position among the highest minimum wage states in the country, with rates around $16.66 or more through inflation indexing.

Mountain and Southwest

Arizona and Colorado are indexing their 2026 increases to inflation, which means their new rate won’t be finalized until late 2025 when the Consumer Price Index calculations are complete. South Dakota will also see an adjustment tied to cost of living metrics.

Midwest and South

Several states are completing multi-year step-ups toward higher floors. Missouri and Nebraska are advancing toward their voter-approved targets. These increases came through the ballot box, where residents voted directly for higher wages.

The HuffPost and Axios coverage confirms that by late 2026, a significant number of jurisdictions are projected to hit or exceed $15 and $17 per hour. Many of these increases are part of multi-year laws passed earlier—for example, step-ups toward the 15 minimum wage in states like Florida, Missouri, and Nebraska. Others are automatic inflation adjusted increases tied to the Consumer Price Index.

Workers in the 20 states stuck at $7.25 will not see a state-mandated increase on January 1, 2026, unless they live in a city or county with its own higher local minimum wage.

States and Cities Reaching $15 or More in 2026

Crossing the $15-an-hour threshold remains a key policy goal and political benchmark in many places. For years, the “Fight for $15” movement pushed this number as a target for economic security, and 2026 marks a significant year for reaching that milestone.

Using data summarized by Axios and HuffPost, by the end of 2026 dozens of jurisdictions—including California, New York, Washington State, and parts of New England—will have minimum wages at or above $15 per hour. Many large cities will exceed $17 per hour.

Florida reaches a major milestone when its statewide minimum wage rises to $15.00 on September 30, 2026. This increase was voter-approved in 2020 and has been implemented through annual $1 increases every September 30. This makes Florida one of the most significant states to join the 15 minimum wage club.

Missouri and Nebraska are scheduled to complete their step-ups to around $15 in 2026. Both states passed these increases through ballot initiatives, demonstrating the power of direct democracy in raising wages when legislatures don’t act.

New York City, Long Island, and Westchester will be at $17.00 per hour from January 1, 2026. This means workers in York City Long Island and Westchester County will be well above the $15 threshold, with Long Island and Westchester matching the city’s rate.

West Coast cities continue leading the nation. Seattle, Tukwila, and other municipalities in Washington State have local minimums exceeding $17, with some reaching into the low $20s per hour for large employers. Tukwila notably became the first city in the nation to exceed $20 per hour for its minimum wage.

California cities like West Hollywood and San Francisco maintain local minimums in the high teens to low $20s in 2026. San Diego also has a local minimum that exceeds the state floor, and the city continues to adjust for inflation.

According to policy tracking cited by HuffPost and Axios, 79 or more jurisdictions are expected to be at or above $15 by late 2026, with many clustered in high-cost coastal and metro regions.

Local rates can exceed state floors, so workers should always check both their state minimum wage and any applicable city or county minimum wage. The highest applicable rate is what employers must pay.

Mid-Year 2026 Adjustments: July 1 and Other Dates

Not all wage increases occur on January 1. Some states and cities schedule changes for July 1 or other specific dates, creating multiple moments throughout the year when the minimum wage will go up.

Washington, D.C. is the primary example of a July 1 adjustment. Its minimum wage is indexed to the Consumer Price Index and adjusts every July 1. On July 1, 2025, D.C.’s rate rose to $17.95 per hour, and it will increase again on July 1, 2026 based on inflation calculations. D.C. consistently maintains one of the highest minimum wage rates in the country.

Several West Coast localities also have July 1 cost-of-living adjustments. Cities in Washington State and California may see their already high minimums lift beyond $18–$20 per hour in 2026 through these mid-year updates. These inflation indexing mechanisms mean the exact new rate often isn’t known until official announcements are made.

Additional state-level adjustments may occur later in 2026 where laws tie wages to inflation or include second-half-of-year step increases. Workers and employers should verify each state’s labor department announcements to confirm exact dates and amounts.

How Many Places Are Raising Minimum Wage in 2026?

The 2026 minimum wage landscape involves a significant number of jurisdictions taking action while others remain stagnant.

Based on policy trackers summarized by HuffPost and Axios, around 88 jurisdictions nationwide—roughly 22 states plus 60+ cities and counties—are expected to raise their minimum wages at some point during 2026.

According to Fox Business, 19 states will see increases on New Year’s Day 2026. The Axios tally of New Year minimum wage changes aligns with these counts.

The WFAA article details specific cities and states implementing new higher minimums on January 1, 2026. These include both major metropolitan areas and smaller municipalities responding to local cost of living pressures.

Here’s the breakdown of 2026 minimum wage action:

| Category | Count | Notes |

|---|---|---|

| States raising wages (total 2026) | 22–23 | Various effective dates |

| States at federal $7.25 | 20 | No scheduled increase |

| Cities/counties raising wages | 60+ | Many on January 1 |

| Jurisdictions at $15+ by end of 2026 | 79 | Up from prior years |

| Jurisdictions at $17+ by end of 2026 | 57 | Primarily coastal/metro |

While many jurisdictions are moving toward higher wage floors, the 20 states remaining at the federal $7.25 reinforce regional disparities in worker pay and affordability. Most of these states are concentrated in the South and parts of the Great Plains.

How Inflation and the Affordability Crisis Shape 2026 Increases

The push for 2026 wage hikes is closely tied to a nationwide affordability crisis that has intensified since 2020. Minimum wage increases are essential for improving workers’ earnings and addressing affordability issues. Workers gain financial stability and improved living standards from higher minimum wages, which help them better afford living costs and achieve greater economic equity. Rising living costs necessitate higher minimum wage targets to ensure economic security for workers.

As cited by HuffPost and Axios reporting, prices have risen over 20–23% since 2020 according to the Consumer Price Index. This inflation has eroded the value of stagnant wages and especially devastated workers still paid the unchanged $7.25 federal minimum. A wage that was already difficult to live on in 2009 purchases significantly less today.

Many of the 2026 increases fall into three categories:

Automatic inflation indexing happens in states and cities that link annual minimum wage changes to the Consumer Price Index. Washington State, Colorado, Arizona, and D.C. all use this mechanism. Each year, jurisdictions apply a CPI-based formula to set new wage levels.

Scheduled steps in multi-year laws are common in states that passed phased increases. Florida’s $1-per-year schedule toward $15 is a prime example. These wage ladders provide predictability but can fall behind if inflation accelerates faster than the scheduled steps.

Local ballot initiatives or ordinances respond to housing and rent spikes in major metros. Cities like San Diego and West Hollywood have passed measures that set local minimums well above state floors.

Inflation indexing means some exact 2026 figures aren’t known until late 2025 when official CPI data is released. This creates uncertainty for employers trying to plan payroll budgets.

Even with these increases, many workers living in high-cost cities will still struggle to keep up with rent, transportation, and food costs. The gap between rising prices and actual earnings remains a challenge for economic security.

What About Tipped Workers and Sector-Specific Minimum Wages?

Tipped workers and certain industries often follow special minimum wage rules, which also change in 2026.

In some states—including California, Minnesota, and Montana—employers cannot use a tip credit. This means tipped workers must be paid the full state or local minimum wage in cash, with tips on top. These states treat the minimum cash wage identically to the regular minimum wage.

In other states, a lower cash wage plus tips must at least equal the applicable minimum wage. When jurisdictions raise their minimum wage in 2026, they often raise the tipped cash wage at the same time.

Hawaii requires tipped employees to receive at least a combined hourly rate (cash wages plus tips) that meets or exceeds the state minimum. If tips don’t bring the worker to that threshold, the employer must make up the difference.

Washington, D.C. is phasing out its tip credit entirely under Initiative 82. By 2027, tipped workers in D.C. will receive the full minimum wage from their employers, with tips added on top. The 2026 rates reflect continued progress toward this goal.

Some sectors have industry-specific minimums that sit well above the general state minimum:

- California’s fast food industry has a separate minimum wage for workers at large fast food chains

- Healthcare workers in California have elevated minimums reaching $21–$23 per hour by 2026–2028 depending on facility type

- Large hotel and airport employers in certain cities face higher local minimums than general retail or service businesses

These sector-specific wages mean more workers are affected by minimum wage changes than the headline state rate suggests.

How to Check When Your Own Minimum Wage Will Go Up

Whether you’re a worker trying to understand your pay or an employer ensuring compliance, finding accurate minimum wage information requires checking multiple sources.

Step 1: Check your state’s Department of Labor website. Every state publishes official minimum wage notices. Look for the 2026 rates and their effective dates. States like California, New York, and Washington post detailed schedules including any industry-specific rates.

Step 2: Look up your city or county government site. Many localities have higher local minimum wage ordinances. Cities like San Diego, Seattle, and New York City Long maintain their own rates that exceed state floors. Search for “[your city] minimum wage 2026” to find local labor standards information.

Step 3: Confirm whether your jurisdiction indexes to inflation. This can add a mid-year or annual adjustment that isn’t finalized until late in the prior year. If your area uses the Consumer Price Index for adjustments, the exact 2026 rate may not be published until fall 2025.

Step 4: Verify your job category. Tipped workers, student workers, small business employees, agricultural workers, and certain exempt employees may have different rules. Check if your specific situation has any exemptions or different rate schedules.

Look for effective dates carefully—January 1, July 1, and September 30 are the most common. Also watch for separate rates by employer size, which are common in cities like Seattle and New York.

Employers operating in multiple states must always pay the highest applicable minimum—whether that’s federal, state, or local—where the employee actually performs the work. Multi-location businesses should review all federal state and local requirements for each work site.

Frequently Asked Questions

Will the federal minimum wage increase in 2026?

No federal increase is scheduled for 2026. The federal minimum wage remains $7.25 per hour unless Congress passes new legislation. Despite various proposals over the years, no bill has advanced to raise the federal rate. Workers in states without higher state or local minimums will continue earning the federal floor.

If my state stays at $7.25, can my city still raise the minimum wage?

In many states, cities and counties are allowed to set a higher local minimum wage. However, some states have laws that preempt local wage ordinances, preventing cities from setting rates above the state minimum. You’ll need to check your state’s specific laws—states like Texas and Georgia generally don’t allow local minimums, while states like California explicitly permit them.

Do employers have to raise the pay of workers already above minimum wage?

Employers are not legally required to raise wages for employees already earning above the new minimum wage when increases take effect. However, many employers do adjust pay for workers earning just above the new minimum for morale, retention, or internal equity reasons. This “ripple effect” means minimum wage increases often benefit more workers than just those at the exact minimum.

How do minimum wage increases affect overtime-exempt salary thresholds?

In some states—including California, Colorado, Maine, New York State, and Washington—the minimum salary for overtime exemption is tied to the state or local minimum wage. As hourly minimums rise in 2026, those salary thresholds will increase proportionally. This can affect which employees qualify as exempt from overtime requirements and may require employers to either raise salaries or reclassify workers.

Where can I find official 2026 minimum wage numbers for my state?

Official information is usually posted by your state Department of Labor. The U.S. Department of Labor’s Wage and Hour Division maintains a helpful chart of state minimum wages as well. For local rates, check city or county labor standards offices or economic development departments. Industry publications like new report releases from employment law firms also track these changes throughout the year.

Conclusion

As 2026 approaches, the landscape of minimum wage law in the United States continues to evolve, with more states and cities set to increase their minimum wage rates and expand protections for workers. While the federal minimum wage remains at $7.25 per hour, millions of employees will benefit from higher state and local wage floors, especially in regions like New York, California, Washington State, and Florida. These minimum wage increases are a critical tool for addressing the affordability crisis and helping workers keep pace with rising prices.

For both workers and employers, staying informed about when and how the minimum wage will go up is essential. With wage floors changing at the federal, state, and local levels, and with some cities setting rates well above the federal minimum, it’s important to check official sources regularly to ensure compliance and to understand your rights and responsibilities. As more jurisdictions move toward $15 per hour and beyond, the push for higher wages and economic security remains a central issue for the country’s workforce.

Whether you’re directly paid minimum wage or indirectly affected by wage ladders and pay increases, the changes coming in 2026 will shape the earnings and economic outlook for millions. By keeping up with the latest minimum wage law updates, you can better navigate the evolving world of work and ensure fair pay in the year ahead.